Dynamic pricing is a powerful tool for maximizing revenue. By using a flexible pricing policy, you can ensure your business continues to grow. Changing an item's price can be challenging because it can significantly impact your revenue. However, combining dynamic pricing with the right promotions can optimize your income and maximize your profit margin.

This article will explore how dynamic pricing has helped companies like Airbnb, Zappos, The Container Store, and more through data intelligence reach unprecedented success while enjoying staggering growth and increased sales.

What is Dynamic Pricing?

Dynamic pricing allows you to change the price of your products and services. While you might be inclined to think that your prices should be set and never change, this is only sometimes the case. Dynamic pricing is a great way to increase your revenue because it allows you to change your prices based on demand. You can also choose specific times of the year, such as holidays or peak seasons when you raise your expenses.

The idea behind dynamic pricing is that by adjusting the price for each product or service, you can eliminate all inventory that would otherwise remain unsold. In this sense, dynamic pricing is similar to supply and demand - the more in demand an item is and the less available it is, the higher its price.

Large organizations may have experienced this at some point. You may buy a product or service at a specific price, and after a short period, the price goes up. This happens because factors can increase or decrease demand for your product. You might not be able to change your pricing, but you can use dynamic pricing to help manage demand across long periods of time.

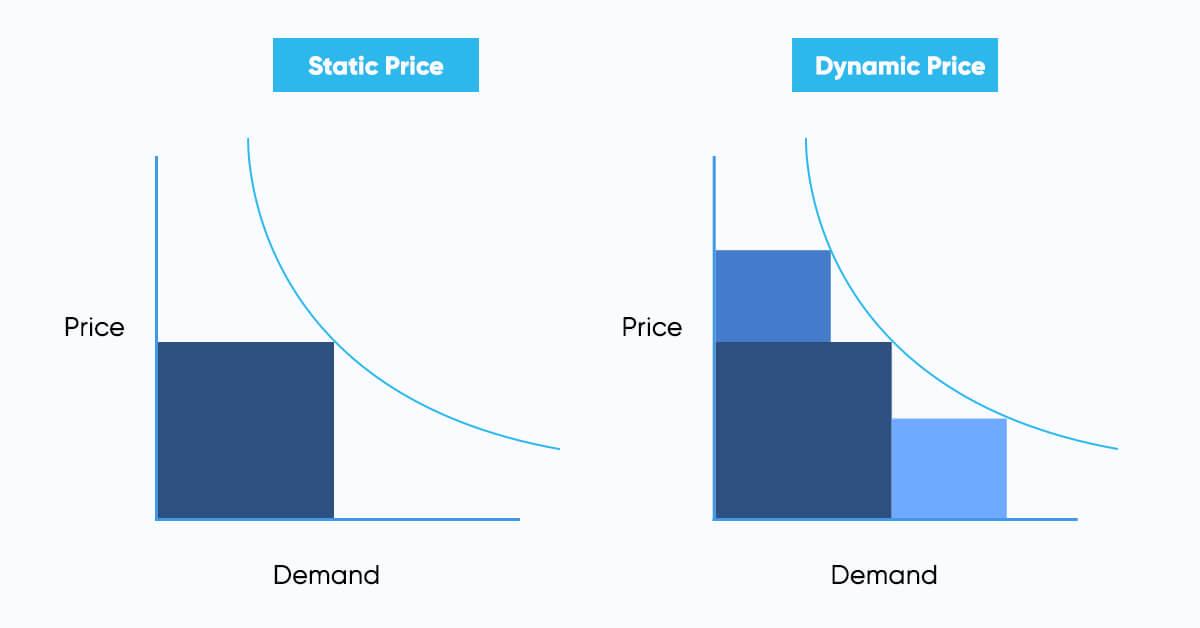

Determining The Difference between Static and Dynamic Pricing

There are two types of pricing: static and dynamic. In general, static pricing is used when you have no fluctuations," such as an hourly rate. It's very rigid and doesn't consider changes in the market. You would no longer update your prices.

The other type of pricing is dynamic. Dynamic pricing allows you to raise and lower your items' prices in response to market conditions. The more available the item is, the higher its price, but you can reduce costs when demand is high.

When Should I Use Dynamic Pricing?

Since dynamic pricing is based upon supply and demand, you wouldn't need to overthink it because it will all be decided for you.

While this might be true in some situations, you should remember a few points. First, consider how often you price your items. You can choose to price all of your products or services based on demand, which may cause your sales to be unpredictable. For example, if there's a great demand for a product or service at one time of the year but very little demand during other times, it might be better to stick to static pricing.

Another factor affecting your decision is the price margin you get when using dynamic pricing. Ask yourself what will happen if the market changes or the demand for your product drops off.

How Dynamic Pricing can Maximize Business Revenue?

Dynamic pricing is one of the most vital tools to succeed in a competitive and growing market. It's not just an easy way to make money but also allows you to increase your revenues each year. Here are a few situations in which dynamic pricing can help you maximize revenue:

1. When The Market is Trending Upward

You need to be careful when utilizing dynamic pricing because your products or services will constantly change. It's important to factor in the cost of changing the price of your items. If the market is always trending upward, such as with real estate or stocks, it doesn't make sense for you to sell your products at a fixed price. Dynamic pricing allows you to sell high-demand items at a higher price than others.

2. When The Market is Trending Downward

Dynamic pricing can still be a great tool if the market is moving downward. You can set prices that decrease as demand decreases. You want to avoid pressure on customers by lowering your costs too much, but if the market keeps dropping, you may need to reduce the price of your items.

3. When There's a Hurdle in Ensnaring Customers

Some products are very easy and quick to sell. But if these products are in low demand, you should use dynamic pricing since it will increase sales and allow you to get rid of unsold inventory.

4. When It's Difficult to Predict Demand

It's difficult to predict when you will sell more than one unit of a product. For example, some products are seasonal, so it is not a good idea to price them based on seasonality because predicting demand is difficult. With dynamic pricing, you can keep the prices consistent with other seasons but change the price as demand changes. You'll also ensure pricing flexibility for peak seasons and holidays.

How often should you change your product prices?

If you're new to dynamic pricing, you should change your prices constantly to maximize revenue (which is the case). If your pricing stays constant for a short period, your customers will get tired of it. You have to ensure that customers are willing to pay more for the products in high demand. Otherwise, they will turn elsewhere.

The main reason why businesses lose clients is that they've been forced to change their prices too frequently. For example, many online stores were affected by a huge sales event on Amazon during Black Friday. Because of the price competition, sellers on Amazon were forced to lower their prices daily.

If you need help deciding whether to change your prices often or frequently, here's an excellent approach to consider. You can go about dynamic pricing in two ways: making the prices constant and prorating them. Your business will perform well if you change your prices only when necessary, but there are better ways to increase revenue. You should also consider what your customers are willing to pay and demand. In this case, you will be able to attract new and retain old customers by ensuring that they enjoy what they buy from you.

Conclusion

Dynamic pricing is a powerful tool for increasing revenue in an unstable market. But you should use it correctly to avoid losing new and old customers. Your product pricing should align with the market and adapt to fluctuations.

Dynamic pricing is excellent for increasing your profits, but you may need help figuring out what to do next. For example, it probably needs to be better to change prices based on supply and demand; you also need to change your pricing strategy with different types of products. Make sure that the cost of your products is aligned with their value in that niche; otherwise, you'll end up losing money instead of making more of it.

Leave a Reply

Your email address will not be published. Required fields are marked